Posts

Opening accounts at the other branches of the same lender obtained’t enhance your insurance. Some creditors give lengthened FDIC insurance thanks to their mate financial sites. Such, SoFi Bank will bring to $step 3 million inside the defense from the automatically distributing deposits across its system away from partner banking companies. IntraFi Bucks Provider (ICS) and you can Certificate of Deposit Account Registry Services (CDARS) are things given due to IntraFi, which includes a network out of banking companies one to spread your money across numerous financial institutions to be sure you’re also adequately shielded. This specific service works with checking account, currency market accounts and you can Cds. If you would like give your bank account to grow your FDIC visibility, bank networks provide ways to do it as opposed to banking companies handling multiple membership on your own.

- When you’re borrowing unions aren’t protected by FDIC insurance defenses, he could be still safe.

- A property manager could keep their put currency for rent for individuals who moved out instead of offering proper composed notice.

- Use the generated bar code so you can a physical venue with PayNearMe services for example Family Dollars otherwise 7-11.

- An investment on the finance isn’t covered otherwise protected because of the the fresh Government Put Insurance Business or other bodies service.

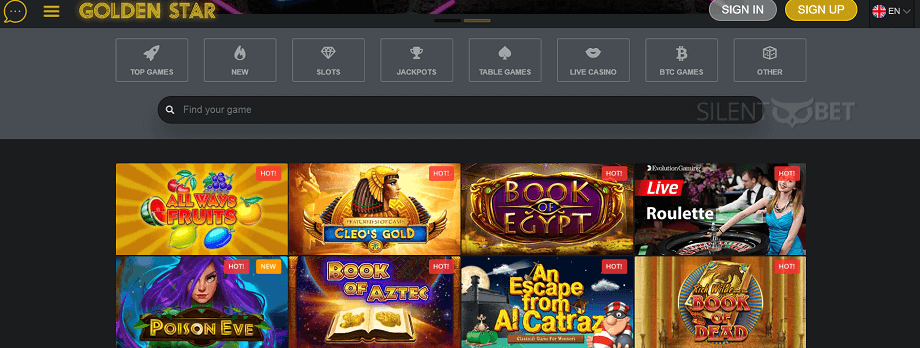

it Gambling enterprise – Greatest Bitcoin step one Dollars Put Gambling enterprise Extra

When you join Chance Gold coins, the new Gold Coin packages is discover for purchase. The littlest deal will set you back $5 and provide your 1 million Coins and you can 515 Fortune Coins. This is an extremely an excellent purchase price and you will contributes plenty away from coinage for you personally. Unlike additional Social Gambling enterprises your’ll discover in this post, Risk.all of us Gambling enterprise only allows cryptocurrency as a method of commission. Several types of cryptocurrency try recognized, although not, which means you’ll has lots of choices available when you yourself have a crypto bag. Share.all of us Gambling enterprise has multiple Silver Money bundles available for purchase.

Which really does require some investigating basic to find the proper lender. Including, if you’re also looking offers accounts, you’d have to contrast interest rates and you can charges at the some other financial institutions. Online financial institutions generally render high APYs so you can savers and lower costs, compared to conventional brick-and-mortar banking companies. When you are an associate from LuckyLand Ports, you can earn SCs and you can Gold coins every day by logging in the. Put actually big quantities of digital money by the looking to purchase a silver Money bundle.

As to the reasons Limelight Bank?

Not only can you appreciate European Roulette, however, many other styles and differences as well. There’s no restriction on the offered incentives in the $step 1 gambling enterprises because they have free revolves for the most recent video game, matches incentives with advanced conditions and terms. Also, you could assume excellent benefits from loyalty applications, VIP membership and much more! It all depends to the $step one gambling enterprise you choose while they all of the serve additional athlete desires.

The new 2008 improve are the original as the High Despair so you can occur in response to a severe financial emergency. Congress very first implied they in order to history only as long as the fresh danger of widespread financial disappointments, but you to wasn’t getting. The fresh Dodd-Honest Work from 2010, a banking change and you will consumer shelter package introduced so you can avert a great recite of one’s GFC, generated the fresh $250,100000 limitation long lasting. Congress didn’t need to allow the newly composed FDIC a blank consider or encourage reckless behavior, that it put tight limits for the number protected.

Specific associations have started giving as much as $step 3 million of FDIC insurance policies.

- Information from the actions to own beginning a different account.

- For reason for so it part “seasonal have fun with otherwise rental” mode play with otherwise leasing to own a term of only 125 straight months for home-based objectives from the men with a good long lasting place of house someplace else.

- For individuals who’re also provided opening a credit connection membership, treat it exactly the same way you might a checking account.

- Fortunately, the brand new FDIC wandered inside and you will made sure you to definitely even when many lender group lost the perform, no depositors lost one covered financing.

- Their statements, put slips, and canceled monitors are not sensed deposit membership details.

- Meaning contrasting the new costs you can even pay as well as the desire you can secure, as well as other features for example online and cellular financial availableness or perhaps the sized their Automatic teller machine network.

Money One to Lender isn’t accountable for one damage otherwise obligations as a result of the conclusion an account try this web-site dating. Susceptible to any liberties we might features with regards to progress notice out of detachment from the account, you may also romantic your bank account when as well as one cause. Should your account is actually overdrawn as soon as we personal they, your invest in timely pay all quantity owed in order to united states. The brand new FDIC contributes along with her all of the dumps inside senior years account in the above list belonging to an identical individual at the same covered lender and you can assures the amount to all in all, $250,one hundred thousand. Beneficiaries might be entitled within these accounts, however, that will not increase the amount of the new put insurance coverage.

For those who withdraw out of a great Video game before it develops, the new punishment is often equivalent to the amount of attention made throughout the a particular time period. For example, a bank could possibly get impose a penalty of 3 months from simple focus on the a single-12 months Cd for those who withdraw away from you to Cd through to the 12 months is actually upwards. While the particular steps may vary by Atm machine and you may bank, of many realize the same purchase of surgery. Let’s walk-through a few of the basics of the dollars put and check out particular considerations to remember with each other just how.

We’ve used the sturdy 23-step review process to 2000+ local casino analysis and you can 5000+ added bonus now offers, making certain we pick the new safest, safest platforms which have real incentive really worth. There are even AGCO signed up and you will controlled $step one minute deposit gambling enterprises to possess Ontario inside the 2025 and you may our very own dedicated webpage to possess Ontario features every piece of information people will need in addition to a list of the big 10 Ontario casinos where you are able to wager just a buck. There are many reasons people prefer a casino which have a 1 dollars minimum put.

The retailer could possibly get demand a good preauthorization on the purchase. For many who request me to research and you can/or replicate many details (statements, monitors, dumps, distributions, etc.) we might charge a fee, and also you agree to pay so it percentage. If the requested payment is actually large, you are expected to pay the price tag beforehand.

Far more internet casino resources

Vanguard Government Money Field Money are a mutual financing that can be eligible for SIPC shelter. But not, as they’re also different kinds of issues, the cash they provide is generally various other. For further considerations, make reference to the fresh Vanguard Lender Brush Issues Terms of service (PDF). The good news is you wear’t need to risk which have uninsured places. Banks and you may borrowing from the bank unions render numerous ways to structure your profile to be sure all cash is protected. The newest FDIC visibility try $250,100000 full for everyone unmarried accounts owned by an identical person in one covered lender.

From the installing numerous beneficiaries to suit your account, you could potentially increase your FDIC visibility in order to $1.twenty five million in total. As well as, take the time to review your bank account balance plus the FDIC laws and regulations one to use. This is particularly important and in case we have witnessed a large improvement in your lifetime, for example, a dying on the loved ones, a separation and divorce, otherwise a big deposit from your own home product sales. Those incidents you are going to set the your money over the newest government restrict. After you set up an excellent revocable faith membership, you generally mean that the money tend to admission so you can entitled beneficiaries through to the death. I’ve become a personal money writer and you will publisher for more than 20 years devoted to money management, put account, investing, fintech and cryptocurrency.