Blogs

A part 162 change or company essentially has people activity if the the connection’s number 1 objective to have getting into the game is actually for income otherwise funds as well as the union are involved in the activity which have continuity and frequency. More resources for just what qualifies as the a trade or company to possess purposes of section 199A, see the Recommendations to own Mode 8995, Qualified Business Income Deduction Simplified Calculation; and/or Instructions to possess Function 8995-An excellent, Certified Organization Earnings Deduction. Inside Year step one, a collaboration borrows $step 1,one hundred thousand (PS Liability 1) away from Financial 1 and you can $1,one hundred thousand (PS Liability 2) from Bank dos.

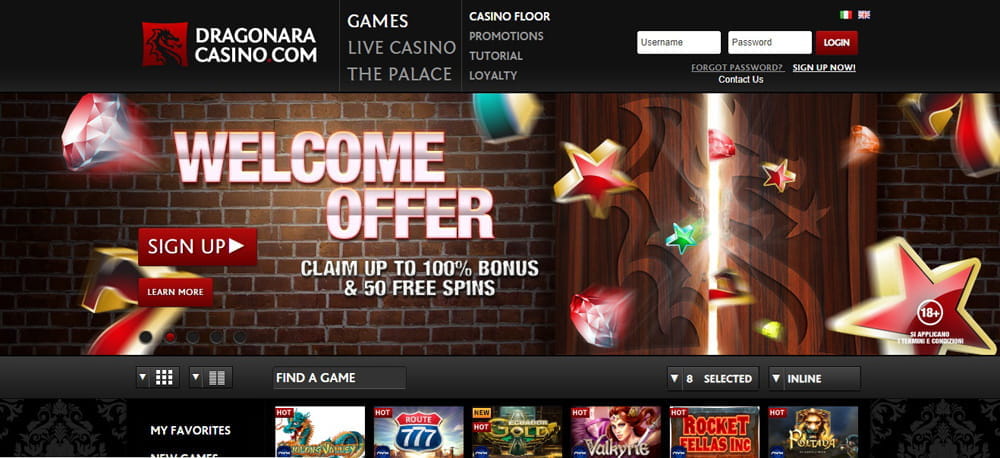

File: gladiator play for fun

Such, it chooses the new bookkeeping method and decline procedures it will explore. The partnership in addition to makes elections under the pursuing the parts. When a partnership’s government go back is amended otherwise changed for your need, it might affect the partnership’s condition taxation return.

Bing Pay

Mode 8938 need to be filed each year the worth of the new partnership’s specified international monetary possessions matches otherwise exceeds gladiator play for fun the brand new revealing tolerance. For more information on home-based partnerships that will be given home-based agencies as well as the kind of international economic property that must definitely be said, see the Guidelines to possess Form 8938. Enter into any other trade or organization money (loss) perhaps not included for the outlines 1a because of six. Such as, don’t were disgusting receipts away from agriculture on the internet 1a. Along with, don’t is on the internet 1a leasing hobby income otherwise collection earnings. To have laws out of whether a foreign union need to file Setting 1065, come across Just who Must Document , prior to.

For each Plan K-step 1, enter the identity, target, and you may pinpointing number of the relationship. When tying comments to Agenda K-1 in order to report more details for the partner, suggest you will find a statement for the following. So that possibly a publicity or a DI to own nice exposure, they should make themselves open to satisfy personally to your Irs in the us during the quite a long time and set while the influenced by the newest Internal revenue service, and ought to have a street address in the united states, an excellent U.S.

/cloudfront-us-east-1.images.arcpublishing.com/gray/PSAMPXCQB5D7JJSVFUFDBJURF4.png)

To the Union X’s Form 1065, it should address “Yes” in order to question 2b away from Schedule B. Discover Example dos on the tips to possess Plan B-1 (Form 1065) to possess tips on providing the remaining guidance needed of agencies responding “Yes” to this concern. Usually do not subtract money to possess lovers so you can old age otherwise deferred payment agreements and IRAs, qualified plans, and you will basic staff retirement (SEP) and easy IRA plans about range. These types of quantity try said in the field 13 out of Agenda K-1 using password R and therefore are deducted from the people for the her productivity.

Net Funding Taxation Revealing Criteria

While the couples are usually allowed to make this election, the connection can not subtract these number or is him or her since the AMT items to your Agenda K-1. Instead, the connection goes through all the information the fresh partners have to figure the separate deductions. Online 13d(1), enter the form of costs said on the web 13d(2). Go into on the internet 13d(2) the newest qualified costs paid back or obtain within the tax season for which an enthusiastic election lower than section 59(e) get use. Enter that it number for everyone couples even if any partner tends to make an election under area 59(e).

Go out Witch

Here, the new accused are extremely females and frequently confronted with torture ahead of getting killed or forced to flee. India’s National Offense Details Agency submitted 2,468 murders stemming out of witchcraft allegations between 2001 and you will 2016, several one to most likely does not be the cause of all the experience and and therefore doesn’t come with advice where accused witches lasted its ordeal. Even when this type of persecutions try illegal and various Indian says provides enacted legislation centering on the fresh habit, they will continue to endure.

If your relationship produced a keen election to subtract a portion of its reforestation costs to the Plan K, line 13e, it ought to amortize more than a keen 84-day several months the new part of this type of costs in excess of the new count deducted to the Agenda K (see area 194). Subtract on the internet 21 precisely the amortization ones a lot of reforestation expenditures. Enter the partnership’s contributions to help you staff benefit programs maybe not advertised someplace else for the come back (such, insurance, health, and hobbies apps) which are not section of a retirement, profit-sharing, etc., bundle included on the internet 18. In case your relationship states a deduction for timber depletion, over and you may attach Function T (Timber), Forest Items Schedule.

Mount a statement in order to Schedule K-1 demonstrating the fresh partner’s distributive show of one’s numbers that partner uses to work the newest amounts to writeup on their Mode 3468, Part II. If the union retains a primary or secondary need for an enthusiastic RPE you to definitely aggregates numerous positions otherwise enterprises, the relationship might also want to are a duplicate of your own RPE’s aggregations with each partner’s Schedule K-1. The partnership can not break apart the brand new aggregation of some other RPE, but it could possibly get add investments otherwise businesses to the aggregation, just in case the new aggregation requirements are fulfilled.

Just how Money Try Common Certainly People

The partnership goes into the newest corrective approach when it comes to property Y. In the 1st 12 months, P have $10 away from section 704(b) guide depreciation, that’s designated equally to A and B to have guide objectives ($5 for each and every). Yet not, P has $0 of income tax decline with regards to assets Y. Within the remedial strategy, for income tax motives, P allocates $5 of corrective income so you can A great and you may $5 from a great corrective depreciation deduction to help you B when it comes to property Y. The newest meanings to your statement basically fulfill the descriptions advertised to the Schedule K-1.

Internet couch potato income of accommodations interest is nonpassive earnings in the event the lower than 31% of one’s unadjusted basis of the home made use of or stored to have play with by consumers on the hobby try subject to decline lower than part 167. Most other Web Rental Income (Loss) , later, to have revealing other online leasing income (loss) aside from rental a home. In the event the a partner engages in a purchase for the partnership, apart from on the skill as the somebody, the newest companion is actually treated while the not a member of the partnership for the transaction. Special regulations affect sales or exchanges out of property anywhere between partnerships and you may particular persons, since the said in the Club. Generally, the relationship find how to figure earnings from its functions.

Acquire Deferral Method

At the same time, an ensured commission discussed inside the point 707(c) is not earnings away from a rental hobby. If you aggregate your own things less than these regulations to possess point 465 intentions, browse the suitable package within the item K beneath the identity and you may target stop to your page 1 away from Form 1065. Install a copy out of Mode 8832 to your partnership’s Setting 1065 for the taxation seasons of your election. If two or more quantity is actually put into figure the quantity to get in for the a line, is cents whenever including the fresh number and you can round away from precisely the full. A collaboration may be required to have one of your following the tax decades. There are many cases where the connection can buy automatic agree on the Irs to switch to particular bookkeeping procedures.

Occasionally the fresh implicated witch you will next be encountered and you can expected to either elevator the fresh curse or spend settlement. Whether or not witches are generally perceived as are human, in lots of communities he or she is paid with fantastic efficiency perhaps not shared from the most people. The idea you to definitely witches can be travel is actually receive not just in early modern European countries (a time covering the fifteenth to 17th ages) as well as inside components of North america, sub-Saharan Africa, Southern area China, and Melanesia. Sometimes it allegedly take action through to steeds; the above mentioned Nyakyusa for example kept so you can a belief one witches travelled through to the pythons, when you’re of very early progressive Europe you’ll find account from witches driving through to broomsticks.

However, it was within the fifteenth millennium that the Christian chapel deemed witches “ready disciples” of your own devil, introducing a strategy out of hunting and doing believed witches in the Europe and you can The usa you to definitely live almost 300 decades, depending on the Collection away from Congress. “The idea of wonders users or individuals who did wonders is in every society, regardless of how far-back you choose to go,” states Blake. Indeed, considering Mar, witch spells most aren’t far unique of traditional prayers. Another difference in Wiccans and you will witches is that of several Wiccans abide because of the Wiccan Rede, a credo one to states “Spoil not one and do as you will,” and this basically function you’re free to create as you delight, except if they adversely influences anyone else. Although people have fun with “witch” and you will “Wiccan” interchangeably, they aren’t necessarily a similar thing.